Are There Any Good Zero-Down Mortgage Programs in Roanoke VA?

Are There Any Good Zero-Down Mortgage Programs?

Coming up with enough money for a down payment is one of the biggest obstacles new borrowers can face. And when you add closing costs to the mixture it can be an even bigger challenge. Most mortgage programs available today require some form of down payment.

Conventional mortgage programs ask for a down payment but you don’t need to have 20% to put down. You can put 5% down or even 3% down on a conventional loan but you’ll also have to add private mortgage insurance, or PMI to that monthly payment. This can certainly affect affordability, and with mortgage rates still at rates not seen for more than 20 years, that’s an issue. FHA loans can also ask for a minimum of 3% down but again there are additional fees to that loan along with mortgage insurance. So, is there any good program out there that doesn’t require a down payment?

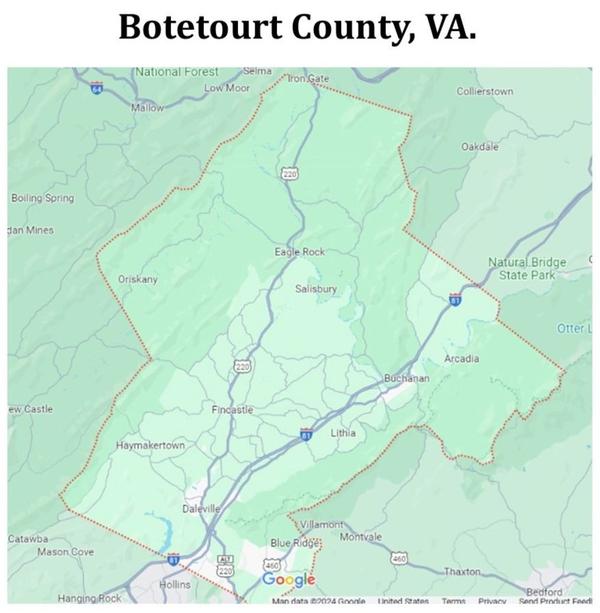

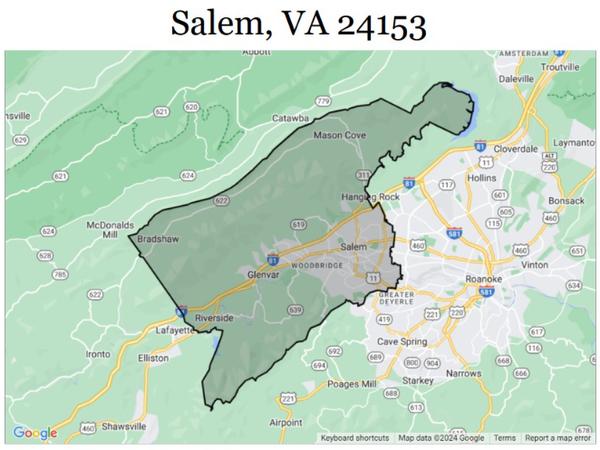

One such program is sponsored by the United States Department of Agriculture or USDA. USDA mortgages don’t require a down payment. But some restrictions apply. For one, the property must be located in a pre-designated area. The USDA program evolved to help populate and establish rural areas. You can find the USDA home loan site, enter the zip code of the home you’re looking to buy, and the site will tell you if it’s in an approved zone.

There are also income restrictions for this program which will vary by region. You might find a household income limit of say $36,600 while up the road the income limit might reach $58,000 for the very same program. USDA loans also have one one-term option of 30 years. Rates are set by the USDA and currently, they’re below conventional rates. There are other times when the rates are higher than conventional. You’ll need to do a little homework with this one.

The other zero-down program is one of my favorites for those who qualify. The VA loan doesn’t require a down payment, either. Further, interest rates on VA loans can be very competitive. Individual lenders set VA interest rates, not the VA, with varying loan terms.

Who is eligible for the VA program? Active duty personnel with at least 181 days of service, honorably discharged veterans, National Guard members with at least six years of service as well as surviving spouses of veterans who have died while serving.

If you’re looking at somewhere rural, most definitely check out the USDA program. And if you’re an eligible borrower for the VA loan, hands down it’s the best option.

We are always here to help you and have several amazing local Loan Officers to refer. You can reach out to us a 540-537-9281 by text or call.

Click here to search for homes

Previous blogs

How are mortgage rates created?

Categories

Recent Posts